Background

Civil Society Organizations in Ghana have over the years advocated for the removal of taxes on sanitary products in Ghana to end period poverty and enable young girls and women to access sanitary products without any financial constraints.

According to UNESCO (2014), one (1) in ten (10) girls in Sub-Saharan Africa are unable to attend school during their menstrual cycle, with most girls being absent from school for an average of four (4) days in a month resulting in the loss of approximately 13 learning days equivalent in each school term. In an academic year which is nine (9) months, an adolescent girl loses 39 learning days, equivalent to six weeks of learning time, due to a lack of sanitary pads (UNESCO, 2014; Lusk-Stover et al, 2016). The cascading effects of this situation on girls’ lives are dire, influencing their ability to participate in the formal economy to improve their livelihood and thus, widening the gender and income inequalities.

Taxes on Sanitary Pads in Ghana

The Government of Ghana, under the Harmonized System Code 9619001000, classifies sanitary pads as ‘Miscellaneous Manufactured Articles’ which subjects them to a myriad of taxes including: 20% import duty; 15% Import VAT, and other import and statutory levies.

This means that under the current tax regime, taxes are imposed on a biological necessity that women have no control over; thereby making sanitary pads unaffordable and inaccessible, especially to low-income households. Sanitary products are currently enlisted in chapter 96 of the Harmonized System, and that attracts a 32.5% tax on imported sanitary pads, which comprises a 20% import duty and a 12.5% Value Added Tax. The impact of the taxes is the high cost of a pack of menstrual pads which are between 20.00 – 40.00 Ghana Cedis.

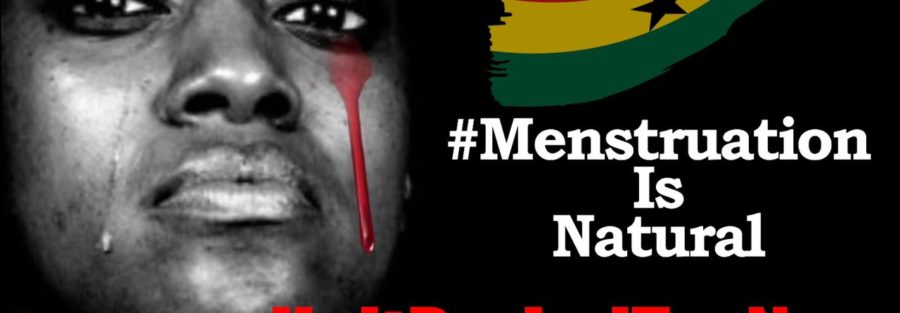

It needs to be re-emphasized that menstruation is a natural phenomenon and the imposition of taxes on sanitary pads which is a basic necessity of life is reinforcing negative gender and social norms which we strive to minimize. The lack of accessibility and affordability is throwing girls and young women out of school and businesses which further widens the inequality gap in education and economic empowerment of women and girls. There are health implications for girls and young women who resort to the use of unhygienic menstrual products because sanitary pads are expensive.

Intensified Advocacy in 2023

This year, under the leadership of the Ghana CSOs Platform on the SDGs, civil society, including the Alliance for Reproductive Health Rights (ARHR) intensified advocacy for the removal of taxes on all sanitary products. Starting from the commemoration of the 2023 Menstrual Hygiene Day on 28th May, a series of campaigns dubbed ‘Don’t Tax My Pad’ were held, both in person and on social media and petitions were submitted to Ghana’s Ministry of Finance, Ministry of Health, Ministry of Gender, Children and Social Protection, and Parliament. CSOs organized ‘X’ storms, ‘X’ chats, webinars, press conferences and demonstrations. Stakeholder engagements were had with policymakers and industry players, all intending to get the government to remove taxes on sanitary products. Civil society shares the belief that all products (sanitary pads, reusable pads, etc.) should be made affordable, accessible, and available to enable women and girls not to miss out on any educational and economic activities during their menstrual cycle.

This year’s campaign got the attention of key persons in Ghana including the Speaker of Parliament, some members of Parliament, and former President of Ghana, John Dramani Mahama, who added their voices to the advocacy and urged the government of Ghana to remove taxes on sanitary products.

The Success

Ahead of the 2024 budget reading, renewed strength and energy were geared toward the advocacy for the removal of taxes on sanitary products. Social media campaigns including ‘X’ Storm, Chat, and press conference were held, and bold statements were released. On the day of the budget reading at the Parliament House of Ghana, CSOs lined up at the premises holding placards with the simple message to the government to ensure the removal of taxes on sanitary products in the 2024 budget.

A few minutes into the budget reading, Ghana’s Minister of Finance made the long-awaited announcement – the government will implement zero rate VAT on locally produced sanitary pads; and grant import duty waivers for raw materials for the local manufacture of sanitary pads.

Though this is not 100%, as it does not include foreign or imported sanitary products, it is still a good win for advocacy.